Reporting on Mutual Funds at the Annual Tax Return

Paying taxes is an obligation for all citizens. How do mutual funds that comply with tax regulations be considered as income that is excluded from the tax object? As income is exempt from tax objects, investors do not need to pay taxes on profits from their investment. However, mutual funds still need to be reported in our annual tax return.

How to report mutual funds to the annual tax return?

There are 2 types of mutual fund reporting in the Annual Tax Return, which are as assets if the mutual funds are still owned and as Non-Tax Revenue if they are sold. The reporting procedure is as follows.

Before reporting taxes, first investors must determine the type of tax return form that will be used. In general there are 3 SPT forms for individuals :

Type 1770 SS This form is filled in by taxpayers who have income from only one employer with an amount of gross income from work of not more than Rp. 60,000,000.00 (sixty million rupiah) a year and do not have other income.

Type 1770 S The form is used by an individual taxpayer whose income is more than one employer, or his income is more than 60,000,000 a year or the WP has other income (for example bank interest, stock dividends, and other income).

Type 1770 This form is intended for taxpayers who earn income from business / work carrying out accounting or Net Income Calculation Norms, having one or more employers, who are subject to Final Income Tax and or are Final and / or other income Investment Fund Reporting for as Assets or as Non-Tax Revenue are the same for all three types of forms. The only difference is the location.

How do you fill in an Investment Fund tax form?

Reporting on mutual funds for assets or non-taxable income is the same for all three types of forms. The only difference is the location.

For Form 1770 SS, it is located on the first page points 10 and 11.

For form 1770 S,the location is as follows :

Mutual Funds as assets (Appendix II Part B) :

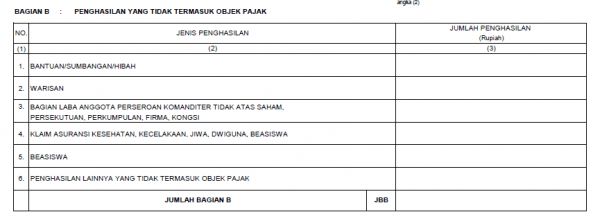

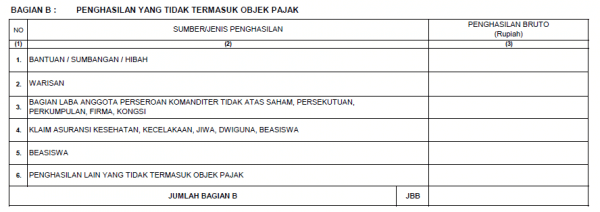

Mutual Funds as income are not taxable objects (Attachment I Part B Point 5) :

For form 1770, it is as follows

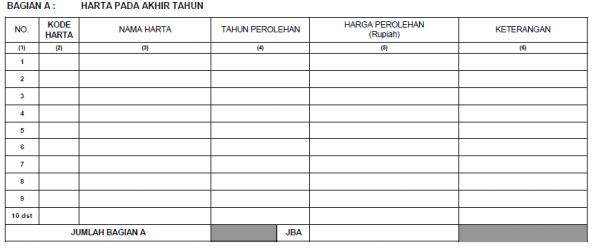

Mutual Funds as assets (Appendix IV Part A) :

Mutual Funds as income are not taxable objects (Attachment III Part B Point 6) :

After knowing the type of form used and its location, how to report the Mutual Fund tax?

The next step is to report the value. In accordance with the discussion, there are 2 mutual funds are reported as assets and mutual funds are reported as non-taxable income.

Reporting on Mutual Funds as an Asset

The right way to report mutual funds as assets is to report based on the acquisition value. Because of people's ignorance, there are still those who report market value at the end of the year. But after checking tax regulations, assets owned are reported using the purchase price, also known as acquisition assets.

Reporting on Mutual Funds as Income Not a Tax Object

Referred to as revenue is the portion of profits obtained if an investor sells a mutual fund. Profits in mutual funds are calculated using the difference between the purchase price and the selling price multiplied by the unit sold and reduced by the sales costs if any. If the purchase is made more than 1 time, the purchase price used is the average purchase price.

What if you sell multiple times ?

The profit from several transactions must be added up and then report the total.

What if you lose ?

If you are loss, you don't need to report it in the tax return in the Income not Tax Object section. But keep in mind that if there are sales, the value of mutual fund assets will also be reduced.

What if I do a switching transaction ?

A switching transaction is the same as selling an old mutual fund and buying a new one. When the sale of an old mutual fund is carried out, the conditions are the same as redemption.